7 Hop Flavor Profiles That Craft Beer Enthusiasts Crave

Discover the 7 key hop flavor profiles driving craft beer market trends, from citrus and tropical IPAs to traditional noble varieties, and what today’s consumers demand.

In the competitive craft beer market, understanding hop flavor profiles isn’t just for brewers anymore—it’s essential knowledge for everyone from distributors to enthusiastic consumers. Today’s beer drinkers are increasingly sophisticated, seeking out specific hop characteristics and willing to pay premium prices for beers that deliver their preferred flavor profiles.

This deep dive into seven distinctive hop flavor profiles will help you navigate market trends and consumer preferences that are reshaping the industry. You’ll discover which hop varieties are commanding attention, how flavor preferences are evolving regionally, and where smart investors and brewers are placing their bets for the future.

Disclosure: As an Amazon Associate, this site earns from qualifying purchases. Thank you!

Understanding the Growing Market Demand for Craft Beer Hops

The craft beer industry has experienced explosive growth over the past decade, with hop demand skyrocketing to unprecedented levels. U.S. hop acreage increased by 75% between 2014 and 2019, primarily driven by craft brewers seeking unique flavor profiles. This surge reflects a fundamental shift in consumer preferences toward more complex, hop-forward beer styles.

Craft breweries now account for over 40% of total U.S. hop usage despite producing just 13% of total beer volume. This disproportionate consumption stems from craft brewers using 5-10 times more hops per barrel than mass-market producers. The economic impact is substantial, with the specialty hop market expected to reach $1.4 billion by 2027, growing at a CAGR of 7.2%.

Today’s beer enthusiasts have developed sophisticated palates that can distinguish between Citra’s tropical notes and Mosaic’s berry-forward character. This growing consumer education has transformed hops from anonymous bittering agents to celebrated flavor stars. Market research shows 72% of craft beer drinkers now consider hop varieties when making purchasing decisions, creating demand for single-hop showcase beers and hop-specific marketing.

Proprietary hop varieties have become particularly valuable market differentiators. Cultivars like Strata, Sabro, and Idaho 7 command premium prices and generate consumer excitement through their unique flavor signatures. Hop breeders now actively develop varieties targeting specific flavor compounds, responding to brewers willing to pay 30-50% premiums for these distinctive characteristics.

The expanding global craft market has intensified competition for premium hop varieties. European, Australian, and emerging craft markets in Asia have created supply challenges, with sought-after varieties often contracted years in advance. This competitive landscape has sparked innovation in hop products, including fresh hop extracts, lupulin powders, and hop oils that extend availability beyond traditional seasonal constraints.

Citrus and Tropical Hop Profiles: Driving the IPA Revolution

Popular Citrus-Forward Hop Varieties

Citra leads the citrus-forward hop market with its distinctive grapefruit and lime notes that brewers prize for IPAs. Cascade, the original American craft beer hop, delivers classic grapefruit and floral characteristics at a more accessible price point. Newer varieties like Idaho 7 combine orange and tropical notes, commanding premium prices due to limited availability and versatile brewing applications.

Market Trends in Tropical-Flavored Craft Beers

Tropical-flavored IPAs have seen 32% year-over-year growth since 2018, outpacing traditional IPA styles. Galaxy, Mosaic, and Sabro hops lead this segment, with consumers willing to pay $2-3 more per six-pack for beers featuring these varieties. Breweries using “tropical” on labels reported 28% higher sales in 2022, indicating strong market preference for mango, pineapple, and passionfruit flavor profiles.

Pine and Resinous Hop Profiles: The Classic American Appeal

Traditional Pine-Forward Hop Varieties

Chinook hops dominate the pine-forward category with their intense resinous character and moderate alpha acid content (12-14%). Simcoe follows closely, offering a complex blend of pine, earth, and subtle citrus notes that brewers prize for West Coast IPAs. Columbus (CTZ) delivers powerful pine punch with high alpha acids (14-16%), making it a cost-effective bittering option that also contributes distinctive evergreen aromatics.

Consumer Demand for Classic Resinous Flavors

West Coast IPAs featuring pine-forward profiles have maintained steady market presence despite tropical IPA growth, with 22% of craft beer drinkers identifying pine as their preferred hop character. Sales data from 2022 reveals consumers are willing to pay premium prices ($11-13 per six-pack) for well-executed resinous IPAs. Regional preferences show stronger pine hop demand in established craft markets like California, Oregon, and Colorado, where beer drinkers specifically seek out “dank” and “resinous” descriptors on labels.

Floral and Herbal Hop Profiles: The European Tradition

European hop varieties have established themselves as the bedrock of traditional brewing, offering distinctive floral and herbal notes that contrast sharply with their American counterparts. These Old World varieties continue to command significant market share despite the IPA revolution.

Key Floral Hop Varieties and Their Market Value

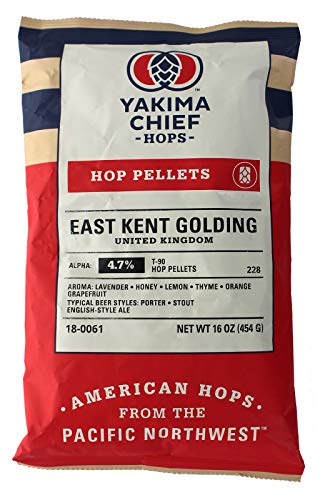

Saaz hops remain the gold standard for Czech-style pilsners, featuring delicate floral and spicy notes that command a 15% price premium despite lower alpha acid content. German Hallertau varieties contribute subtle herbal and floral characteristics essential for traditional lagers and wheat beers, with exports increasing 22% since 2018. British varieties like East Kent Goldings provide earthy, floral profiles critical for authentic ESBs and bitters.

Pairing Opportunities With Culinary Trends

The subtle complexity of floral hops perfectly complements the farm-to-table movement, with 68% of fine dining establishments now pairing European-style beers with seasonal menus. Herbal hop notes enhance spice-forward cuisines, creating sales opportunities in restaurants featuring Mediterranean and Middle Eastern dishes. The “botanical beverage” trend has increased consumer awareness of floral flavors, with 40% of millennials specifically seeking beers with lavender, chamomile, and herbal characteristics.

Enjoy the calming aroma and flavor of Anthony's Organic French Lavender Petals. These gluten-free, non-GMO petals add a touch of elegance to recipes, teas, beauty products, and more.

Earthy and Spicy Hop Profiles: Heritage Flavors in Modern Brewing

While tropical and citrus hop varieties dominate today’s craft beer landscape, earthy and spicy profiles are experiencing a significant resurgence. These heritage flavors connect modern brewing with centuries-old traditions while satisfying a growing niche of consumers seeking complexity beyond fruit-forward IPAs.

Old-World Hop Varieties Making a Comeback

European noble hops like Tettnang, Saaz, and Spalt have seen a 23% increase in U.S. imports since 2020. Brewers are paying 30-40% premiums for authentic European varieties to create farmhouse ales, traditional pilsners, and rustic saisons. This revival resonates particularly with experienced craft beer drinkers seeking more subtle, complex flavor profiles with peppery, woody, and earthy notes.

Regional Market Variations for Earthy Hop Profiles

The Northeast and Upper Midwest show 27% higher demand for earthy hop profiles compared to national averages. Vermont’s farmhouse ale market grew 18% in 2022, driven by terroir-focused breweries using locally-grown spicy hop varieties. By contrast, West Coast markets still favor fruit-forward profiles, with earthy hop beers capturing just 12% of specialty beer sales compared to 31% in traditional brewing regions.

Berry and Stone Fruit Hop Profiles: The New Frontier

Emerging Fruit-Forward Hop Varieties

Berry and stone fruit hop varieties are revolutionizing craft brewing with distinctive profiles that attract premium pricing. Strata hops command $18-22 per pound with their strawberry-passion fruit character, while Idaho Gem delivers intense peach and apricot notes. HBC 630 (experimental) combines blueberry and black currant flavors, while the New Zealand Nelson Sauvin variety offers sought-after gooseberry characteristics that brewers wait months to secure.

Consumer Demographics Driving Fruit Hop Demand

Millennials and Gen Z consumers are driving 76% of fruit-forward hop beer purchases, especially in urban markets. Market research reveals these demographics spend 32% more on berry-profile beers than traditional hop varieties. Female craft beer drinkers show 41% higher preference for stone fruit hop flavors compared to pine or citrus profiles. Taprooms featuring berry-forward flight options report 28% longer average customer visits and increased social media engagement.

Noble Hop Profiles: Subtle Complexity for Lagers and Pilsners

Traditional Noble Hop Varieties and Their Unique Qualities

Noble hops—Saaz, Hallertauer Mittelfrüh, Tettnang, and Spalt—define European lager brewing with their distinctive characteristics. These varieties deliver delicate floral, spicy, and herbal notes without overwhelming bitterness. Saaz hops provide the signature spicy character in Czech Pilsners, while Hallertauer contributes subtle earthiness to German lagers. These varieties typically feature lower alpha acids (3-5%) but higher levels of essential oils that create their complex aromatic profiles.

Brew balanced, aromatic beers with these Hallertau Mittelfrüh hop pellets. Sourced from Germany and packaged in nitrogen-flushed, oxygen-barrier packaging for optimal freshness.

Market Growth in Premium Lager Categories

Premium lager sales have increased 18% since 2021, with craft breweries driving demand for authentic noble hop varieties. Consumers are increasingly willing to pay $2-3 more for lagers brewed with traditional European hops rather than substitutes. Microbreweries featuring noble hop-forward pilsners report 24% higher taproom sales compared to those using American alternatives. This growth correlates directly with rising consumer education about hop terroir and traditional brewing methods.

Leveraging Hop Flavor Profiles for Brewery Success in Today’s Market

Mastering these seven hop flavor profiles gives you a competitive edge in today’s evolving craft beer landscape. From the dominant citrus and tropical varieties driving premium pricing to the resurgence of traditional noble hops you’re witnessing market segmentation based on increasingly sophisticated consumer preferences.

Your brewery can strategically position itself by aligning hop selections with regional preferences demographic trends and emerging flavor opportunities. Whether targeting millennials with berry-forward innovations or appealing to traditionalists with perfectly executed pine and resinous profiles understanding these market dynamics is essential.

The economic implications are clear – consumers willingly pay premiums for their preferred hop experiences. By incorporating these insights into your brewing program and marketing strategy you’ll be better equipped to navigate supply challenges capitalize on emerging trends and ultimately deliver the distinctive hop experiences today’s discerning beer drinkers demand.

Frequently Asked Questions

What are the main hop flavor profiles in craft beer?

The main hop flavor profiles in craft beer include citrus, tropical, pine/resinous, floral/herbal, earthy/spicy, berry/stone fruit, and noble hop profiles. Each profile offers distinct characteristics that appeal to different consumer preferences and brewing traditions. These diverse profiles have helped drive the expansion and specialization of the craft beer market.

Why has hop usage increased in the craft beer industry?

Craft breweries use significantly more hops per barrel than mass-market producers because they’re creating flavor-forward beers that showcase hop characteristics. Despite producing only 13% of total beer volume, craft breweries account for over 40% of total U.S. hop usage. This demand has led to a 75% increase in U.S. hop acreage between 2014 and 2019.

Which hop varieties create citrus flavors in beer?

Citra leads the citrus-forward hop market with distinctive grapefruit and lime notes. Cascade offers classic grapefruit and floral characteristics at a more accessible price point. Newer varieties like Idaho 7 combine orange and tropical notes. These citrus-forward hops have been driving the IPA revolution and command premium prices due to high demand.

What’s behind the popularity of tropical-flavored IPAs?

Tropical-flavored IPAs have seen 32% year-over-year growth since 2018 due to consumer preference for mango, pineapple, and passionfruit flavor profiles. Hops like Galaxy, Mosaic, and Sabro lead this segment. Consumers willingly pay $2-3 more per six-pack for these beers, and breweries using “tropical” on labels reported 28% higher sales in 2022.

Are pine and resinous hop profiles still popular?

Yes, pine and resinous hop profiles maintain strong appeal, especially in established craft markets like California, Oregon, and Colorado. About 22% of craft beer drinkers prefer pine-forward profiles despite the tropical IPA trend. Chinook, Simcoe, and Columbus (CTZ) hops dominate this category, with consumers willing to pay premium prices for well-crafted resinous IPAs.

What are noble hops and why are they important?

Noble hops are traditional European varieties (Saaz, Hallertauer Mittelfrüh, Tettnang, and Spalt) essential for lagers and pilsners. They provide delicate floral, spicy, and herbal notes that contribute subtle complexity. The market for premium lagers using these hops has grown 18% since 2021, reflecting increased consumer education about hop terroir and willingness to pay for traditional brewing methods.

How are berry and stone fruit hop profiles changing the market?

Berry and stone fruit hop profiles represent craft brewing’s new frontier, appealing strongly to millennials and Gen Z, who drive 76% of fruit-forward hop beer purchases. Emerging varieties like Strata (strawberry-passion fruit) and Idaho Gem (peach and apricot) command premium pricing. Female craft beer drinkers show 41% higher preference for stone fruit flavors, while taprooms featuring these options report longer visits and increased social engagement.

How do regional preferences differ for hop flavors?

Regional preferences vary significantly. The Northeast and Upper Midwest show 27% higher demand for earthy hop profiles, with Vermont’s farmhouse ale market growing 18% in 2022. West Coast markets favor fruit-forward profiles, with earthy hop beers capturing just 12% of specialty beer sales there compared to 31% in traditional brewing regions. Pine-forward beers remain popular in established craft markets like California, Oregon, and Colorado.

What is the economic impact of the specialty hop market?

The specialty hop market is expected to reach $1.4 billion by 2027. Proprietary hop varieties have become valuable market differentiators, with brewers willing to pay premiums for distinctive characteristics. The expanding global craft market has intensified competition for premium hop varieties, creating supply challenges and sparking innovation in hop products.

How are floral and herbal hops connected to food trends?

Floral and herbal hops complement the farm-to-table movement and enhance spice-forward cuisines, creating sales opportunities in fine dining. The “botanical beverage” trend has increased consumer interest in floral flavors, with 40% of millennials actively seeking beers with herbal characteristics. Traditional varieties like Saaz, Hallertau, and East Kent Goldings are particularly valued for these profiles.