7 Ways to Get Crop Insurance for Backyard Gardens That Protect Your Harvest

Protect your backyard harvest! Discover specialized insurance options for home gardens, from micro-insurance to cooperative coverage, and learn how to document your garden for successful claims.

Growing your own food is rewarding, but unexpected weather events or pest infestations can quickly destroy months of hard work. While traditional crop insurance typically focuses on commercial farms, there are emerging options for backyard gardeners seeking protection for their vegetable plots and fruit trees.

Grow your own dwarf fruit trees with this variety pack! Includes lemon, cherry, orange, and apple seeds, individually packaged for easy planting and storage. These non-GMO, heirloom seeds boast a high germination rate and require no layering.

In this guide, you’ll discover how to secure proper coverage for your home garden investments through specialized insurance policies, community garden programs, and government-supported initiatives. From understanding policy requirements to calculating appropriate coverage levels, we’ll walk through everything you need to safeguard your backyard harvest.

Disclosure: As an Amazon Associate, this site earns from qualifying purchases. Thank you!

Understanding Crop Insurance Options for Backyard Gardens

Traditional vs. Specialized Garden Insurance

Traditional crop insurance programs primarily serve commercial farmers with extensive acreage, often excluding backyard gardens entirely. These policies typically require minimum acreage requirements of 5+ acres and focus on commodity crops like corn and soybeans. Specialized garden insurance, however, offers tailored coverage for small plots, heirloom varieties, and diverse plantings that characterize home gardens.

Make fresh soy milk and tofu with these 7 lbs of Soymerica Non-GMO soybeans. Identity Preserved and sourced from the USA, these beans are guaranteed to be from the newest crop.

Policy Coverage Limitations for Home Gardens

Most home garden policies cap coverage at $2,000-$5,000 per growing season, significantly lower than commercial farm limits. Coverage typically excludes ornamental plants, focusing instead on food-producing plants like vegetables, fruits, and herbs. Many policies implement a waiting period of 14-30 days after purchase before coverage activates, preventing last-minute purchases ahead of forecasted disasters.

Assessing Your Backyard Garden’s Insurance Needs

Before you can find the right insurance coverage for your backyard garden, you need to thoroughly evaluate what you’re growing and the specific challenges you face.

Calculating the Value of Your Garden Crops

Start by documenting every plant in your garden with its approximate replacement cost. Track your annual seed, seedling, and soil amendment expenses. Don’t forget to factor in the market value of your expected harvest—for instance, organic heirloom tomatoes typically retail at $4-6 per pound. This total value forms the foundation of your coverage needs.

Identifying Specific Risks in Your Growing Area

Research your region’s common weather threats—whether it’s spring hail in the Midwest, summer droughts in the Southwest, or early frosts in northern states. Check your property’s flood zone status at FloodSmart.gov. Note recent pest pressures like Japanese beetles or tomato hornworms and review local extension office reports for emerging disease risks like late blight or powdery mildew.

Exploring Community-Supported Agriculture (CSA) Insurance Programs

Joining Local CSA Insurance Pools

CSA insurance pools offer backyard gardeners a unique opportunity to share risk collectively. These pools function by pooling resources from multiple small growers to provide coverage against crop failures. You’ll typically contribute a seasonal premium based on your garden size and receive compensation when weather events or pests damage your crops. Many local food co-ops and farming associations now facilitate these arrangements, making specialized coverage more accessible for gardens under one acre.

Navigating Membership Requirements

To join most CSA insurance programs, you’ll need to meet specific eligibility criteria. Requirements typically include documenting your growing practices, participating in seasonal inspections, and maintaining detailed harvest records. Most pools require a minimum commitment of one full growing season and may ask you to contribute volunteer hours to the collective. Membership often requires growing at least 5-10 different crop varieties to ensure the risk remains distributed across diverse plantings.

Investigating Micro-Insurance Products for Small-Scale Growers

Digital Insurance Platforms for Hobby Farmers

Several digital platforms now offer micro-insurance specifically tailored for backyard gardeners. Apps like GardenShield and PlantProtect connect you directly with underwriters specializing in small-scale coverage without agent intermediaries. These platforms typically offer lower premiums starting at $9-15 monthly with streamlined claims processes through photo documentation. Many include educational resources about common plant diseases and weather alerts to help prevent losses before they occur.

Pay-Per-Plant Coverage Options

Pay-per-plant insurance lets you insure only your most valuable garden assets rather than the entire plot. High-value plants like heritage tomato varieties, fruit trees, and rare berries can be individually covered for $2-5 per plant seasonally. Coverage activates immediately upon planting and continues through harvest, requiring documentation of each plant’s condition with timestamped photos. Most policies reimburse 75-100% of expected yield value if plants fail due to covered perils.

Utilizing Homeowner’s Insurance Extensions for Garden Protection

Adding Specific Garden Endorsements to Existing Policies

Your standard homeowner’s policy typically doesn’t cover garden crops, but you can add specialized endorsements for garden protection. These endorsements cost between $20-50 annually and extend coverage to food-producing plants damaged by covered perils. Contact your insurance agent to request a “garden produce endorsement” that specifically protects high-value crops like heirloom vegetables and berry bushes from weather events, theft, and vandalism.

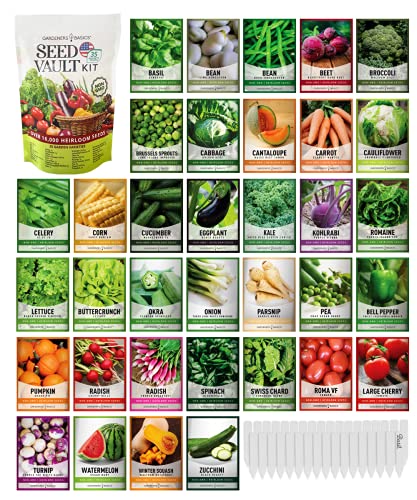

Grow your own food with this survival garden seed kit! It includes over 16,000 non-GMO, heirloom seeds across 35 easy-to-grow vegetable varieties, packed in individual packets with complete growing instructions. Sourced and packaged in the USA for emergency food security.

Understanding Coverage Thresholds for Garden Structures

Garden structures like greenhouses and raised beds typically have different coverage thresholds than your plantings. Most standard policies cover structures up to $500-1,000, while premium endorsements extend protection to $2,500-5,000. Structures must meet building code requirements, including proper anchoring for greenhouses and structural integrity for raised beds. Document all garden structures with photos and receipts to streamline claims processes.

Qualifying for Federal Crop Insurance Programs as a Small Producer

Meeting USDA Requirements for Backyard Gardens

Federal crop insurance isn’t completely out of reach for backyard gardeners, but you’ll need to meet specific USDA criteria. Your garden must produce for commercial purposes, even if sales are minimal. You’ll need documentation of previous yields, typically 3-5 years of production records. Gardens under 1 acre can qualify through micro-farm provisions that were introduced in recent policy updates.

Applying Through the Noninsured Crop Disaster Assistance Program

The NAP program offers your best entry point to federal coverage for small gardens growing non-commodity crops. You can apply at your local Farm Service Agency office with documentation of your garden layout and crops. The application fee is $325 per crop, but fee waivers are available for beginning gardeners and historically underserved producers. Coverage activates 30 days after application approval and provides up to 65% of expected market value.

Working With Agricultural Cooperatives for Group Coverage

Joining Forces With Local Gardeners for Shared Policies

Agricultural cooperatives offer backyard gardeners a powerful option for accessing crop insurance through group coverage. By joining forces with 10-15 fellow gardeners in your area, you’ll create the collective purchasing power needed to qualify for policies typically reserved for larger operations. These shared policies often reduce individual premiums by 15-25% while providing more comprehensive coverage than standalone options. Local garden clubs and community garden networks frequently organize these cooperative insurance arrangements, making it easier to find and join existing groups.

Navigating Cooperative Membership Benefits

Membership in agricultural cooperatives offers benefits beyond just insurance access. You’ll gain voting rights in cooperative decisions, influencing coverage options and claim processes that directly affect your garden. Many cooperatives provide educational workshops on risk management and loss prevention techniques specific to your growing zone. Additionally, members typically receive discounted rates on gardening supplies from partner retailers, with savings of 10-20% on seeds, tools, and organic pest control products. These combined benefits make cooperative membership particularly valuable for serious backyard gardeners.

Documenting Your Garden for Insurance Claims

Creating Comprehensive Garden Inventories

Start your garden inventory by listing every crop variety you’re growing with exact quantities planted. Include seedling costs, soil amendments, fertilizers, and specialized equipment in your documentation. Update your inventory seasonally, noting plant replacements and new additions with dated entries. Store digital copies of your inventory in cloud storage and maintain physical backups in waterproof containers near your garden.

Establishing Proof of Value Through Photos and Records

Photograph your garden weekly from consistent angles to document plant growth and overall condition. Capture close-ups of high-value plants like fruit trees and rare varieties that command premium prices. Keep seed packets, nursery receipts, and farmers’ market price lists to establish accurate replacement values. Create a digital garden journal documenting planting dates, harvest yields, and seasonal maintenance to strengthen potential insurance claims.

Comparing Private Insurance Options for Specialty Crops

Finding Insurers That Cover Heirloom Varieties

When seeking coverage for heirloom varieties, look for specialty agricultural insurers like AgriCover and Heritage Crop Insurance that specifically mention “non-commercial cultivars” in their policies. These insurers typically require documentation of your heirloom seeds‘ provenance and expected market value. Contact local agricultural extension offices for recommendations on regional insurers who understand the higher value and unique risks associated with heritage crops.

Reviewing Rate Structures for Organic Growing Methods

Organic growing methods typically command premium insurance rates 15-20% higher than conventional coverage due to perceived increased pest vulnerability. However, insurers like GreenGrow and OrganicShield offer discounted rates if you implement integrated pest management practices and maintain buffer zones. Compare deductible options carefully—some organic-friendly policies offer lower premiums with higher deductibles ($250-500) while providing more comprehensive coverage for approved organic amendment losses.

Planning Your Garden With Insurance Requirements in Mind

Protecting your backyard garden investment doesn’t have to be complicated. By evaluating your garden’s value exploring specialized coverage options and documenting your growing practices you’re taking essential steps toward financial security for your crops. Whether you choose a micro-insurance product join a cooperative or add an endorsement to your homeowner’s policy there’s a solution that fits your gardening scale and budget.

Remember that the best insurance strategy starts before planting. Design your garden with risk management in mind diversify your crops and implement preventative measures against common threats. With proper coverage in place you can garden with confidence knowing your hard work and investment are protected against unpredictable challenges beyond your control.

Frequently Asked Questions

Can backyard gardens qualify for crop insurance?

Yes, backyard gardens can qualify for specialized insurance options, though traditional crop insurance typically requires a minimum of 5 acres. Specialized garden insurance, micro-insurance products like GardenShield, and community garden programs offer coverage specifically designed for home gardeners. Some backyard gardeners may also qualify for federal programs if they meet certain USDA criteria or through the Noninsured Crop Disaster Assistance Program.

What does garden insurance typically cover?

Garden insurance typically covers damage from weather events, pests, disease, and sometimes theft or vandalism. Most policies focus on food-producing plants rather than ornamental varieties. Coverage usually includes the value of expected harvests, with limits typically ranging from $2,000-$5,000 per growing season. Some policies also cover garden structures like greenhouses and raised beds, though these may require separate endorsements.

How much does garden insurance cost?

The cost varies based on coverage type. Specialized garden insurance premiums start at $9-15 monthly. Pay-per-plant options cost $2-5 per plant seasonally. Homeowner’s insurance endorsements for gardens typically run $20-50 annually. Federal programs like NAP have a $325 application fee per crop, with waivers available for beginning gardeners. Joining agricultural cooperatives can reduce premiums by 15-25% through group rates.

Is there a waiting period before garden insurance becomes active?

Yes, most garden insurance policies impose waiting periods before coverage activates. Typical waiting periods range from 14-30 days after purchase, preventing gardeners from buying insurance at the last minute when disasters are imminent. Federal programs like the Noninsured Crop Disaster Assistance Program (NAP) have 30-day waiting periods after application approval. Pay-per-plant coverage is an exception, as it often activates immediately upon planting.

How do I document my garden for insurance claims?

Create a comprehensive inventory of crops, varieties, quantities, and garden equipment. Take regular photographs throughout the growing season showing plant development. Maintain detailed records of planting dates, harvest yields, expenses, and purchase receipts. Update your inventory seasonally to reflect changes in your garden. For structures like greenhouses, document with photos and keep receipts. This documentation strengthens your case when filing insurance claims.

Can I insure specialty or heirloom crops?

Yes, specialty and heirloom crops can be insured through specialty agricultural insurers that cover non-commercial cultivars. Pay-per-plant coverage options are particularly suited for valuable heritage varieties, offering $2-5 per plant seasonal coverage. Contact your local agricultural extension office for recommendations on insurers familiar with unique risks of heritage crops. These specialized policies may have higher premiums but provide targeted protection for valuable heirloom varieties.

Are there insurance options for community gardens?

Yes, Community-Supported Agriculture (CSA) insurance programs allow gardeners to share risk collectively through insurance pools. These programs enable small growers to pool resources for coverage against crop failures. Members receive compensation for damages from weather events or pests. To join, gardeners must typically meet eligibility criteria such as documenting growing practices, maintaining harvest records, committing to a full growing season, and growing 5-10 different crop varieties.

Does homeowner’s insurance cover my garden?

Standard homeowner’s insurance typically doesn’t cover garden crops, but you can add specific endorsements for garden protection at an annual cost of $20-50. These endorsements extend coverage to food-producing plants against weather events, theft, and vandalism. For garden structures, standard policies usually cover up to $500-1,000, while premium endorsements can provide protection up to $2,500-5,000. Always document garden structures with photos and receipts.